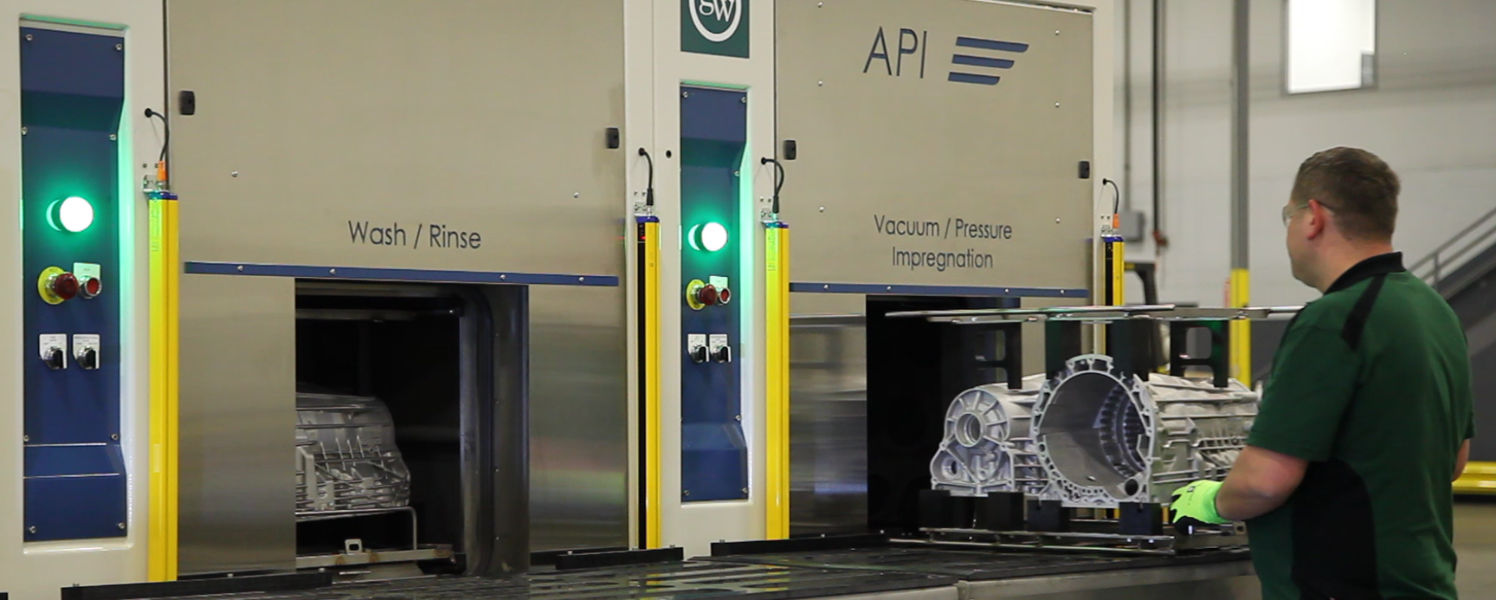

The benefits in owning and operating equipment vs. outsourcing are found in the savings of logistics, quality, and part costs. These savings serve to increase a company’s profitability. This reality holds true for vacuum impregnation equipment. But with many projects and programs competing for a limited amount of capital expenditure dollars, owning vacuum impregnation equipment can seem out of reach. Therefore, many companies default to outsourcing their vacuum impregnation requirements.

Regardless of how a company finances its vacuum impregnation equipment, the highest cost is not found in the equipment, but rather scrap parts due to porosity and non value-added costs of outsourcing. Selecting the right vacuum impregnation process and equipment allows a company to maximize production, improve quality and reduce costs.

This blog highlights the four ways a company can acquire vacuum impregnation equipment while aligning its financial and operational goals.

Outright Purchase

The company owns the equipment outright when purchased. This approach is used when companies secure long-term projects and have upfront capital. Depending on the cost of capital, equipment, and utilities, this is option delivers the lowest possible overall cost. Buying the equipment is favored by most OEMs and Tier One suppliers.

Capital Lease

A capital lease allows a company to operate the equipment and purchase it at the end of the lease. This option is used on long-term projects when access to capital at the beginning of the project may be limited. The company pays a monthly amount plus interest.

The equipment is considered owned by the lessee, so the company accounts for the equipment as a fixed asset and depreciates it accordingly. The obligation under the lease is shown on the balance sheet as debt, and interest expense is recognized as payments are made. The depreciation and interest expense are deductible for taxes, with the depreciation potentially included as bonus depreciation.

Operating Lease

An operating lease permits the use of the equipment but does not convey ownership. After the lease term, the lessor retains the leased equipment or sells it to the lessee at fair market value. An operating lease on vacuum impregnation equipment is commonly used on short-term programs. Like a capital lease, the company pays a monthly amount plus interest.

The equipment is considered owned by the lessor, so the company accounts for the agreement as a rental. Payments are shown on the profit and loss statement as rental expense and are deductible for taxes.

Equipment as a Service (EaS)

Under EaS, the company operates the equipment while ownership of the equipment remains with the manufacturer. The manufacturer charges ‘per use’ therefore allowing the company to classify the charges as an operating expense. The manufacturer provides all equipment, training, maintenance and repairs. The company provides for operation, consumables and utilities. At the end of the agreed term, the company returns the equipment. Again, the per cycle or per use charge is deductible as an operating expense.

The main financial benefit to EaS is that it allows a company to align its production with its costs. The costs are directly related to throughput, and not subject to a depreciation expense schedule.

Conclusion

The various financial options allow vacuum impregnation equipment available to all companies. It is important to align the right purchase option with the company’s financial capabilities. Doing so will maximize part recovery, reduce costs and increase profitability.